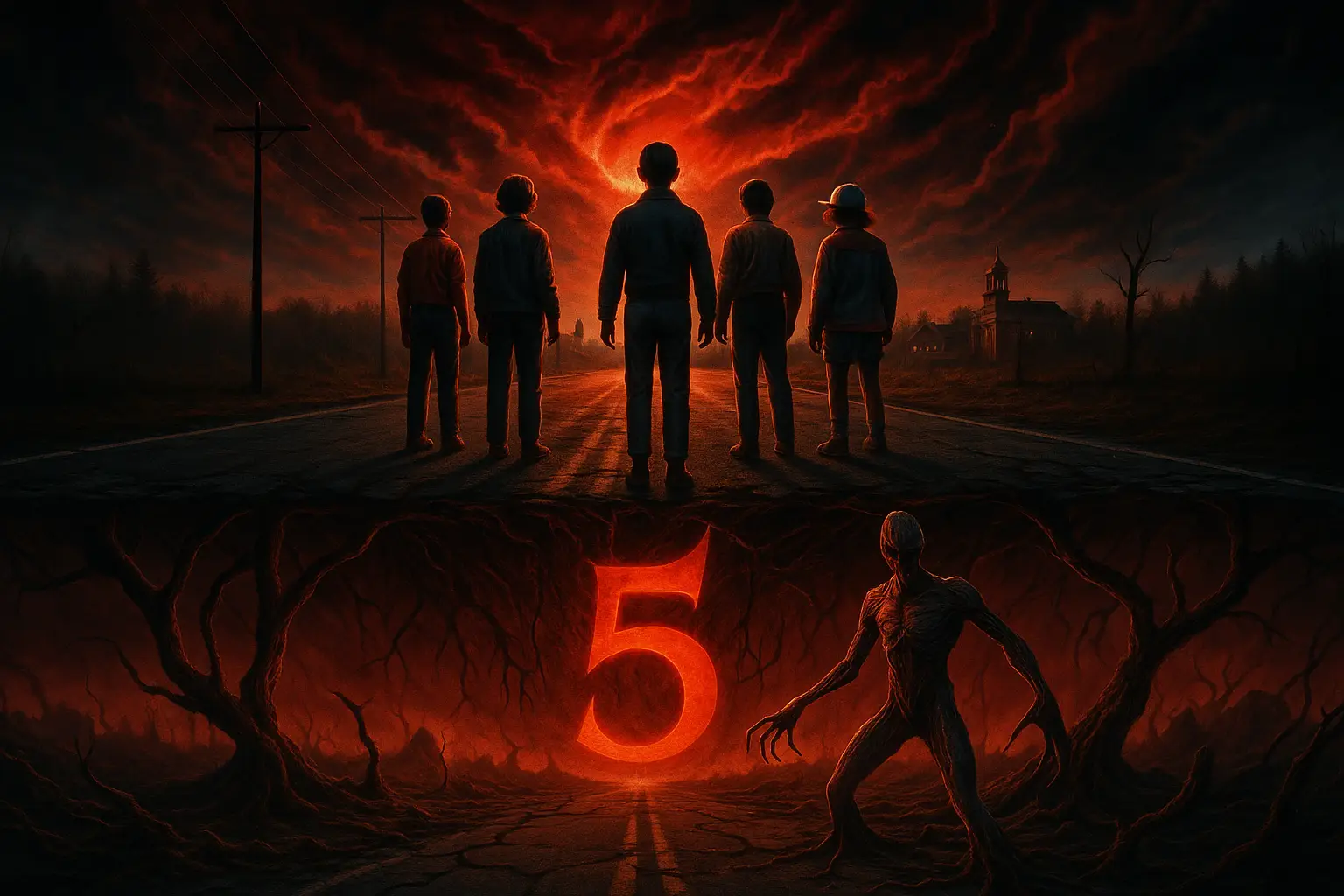

The 5.1 Subscription Household: How Streaming Turned Into America’s New Monthly Habit

If it feels like every screen in your house needs its own login, the numbers back you up.

According to a 2025 BB Media study summarized by industry group CTAM, the average U.S. household now holds 5.1 streaming subscriptions. That figure puts the United States second in the world, behind only India, for the number of streaming subscriptions per home.

At the same time, the number of available platforms keeps climbing. CTAM reports that the U.S. and Canada together had 745 streaming platforms in 2024, even after 40 services shut down that year. Another research firm, Parks Associates, counts 348 standalone streaming services in the region, up sharply from 154 in 2015.

So the 5.1‑subscription household is not a fluke. It is the logical outcome of a market that has exploded in both supply and demand.

How Researchers Count: Why 5.1 Is Not the Only Number

The 5.1 figure comes from BB Media’s analysis of average subscriptions per U.S. household. Other respected firms land in a similar range, depending on what they count and who they survey.

Parks Associates, in its 2025 “State of Streaming” work, finds that 91% of U.S. internet households subscribe to at least one streaming video service and that these households now subscribe to “nearly six services on average.” That number refers specifically to video services, not music or retail subscriptions.

Comscore’s 2025 State of Streaming report goes even further. It estimates that U.S. households subscribe to 6.9 streaming services on average and stream content for nearly five hours per day. Comscore’s definition includes ad‑supported and free services, which helps explain the higher total.

When you widen the lens beyond just video, the picture still looks crowded. A 2025 “Subscriptions Assemble” study by Bango, based on 5,000 U.S. subscribers, finds that the average American pays for 5.4 subscriptions overall, across streaming, music, retail, and other categories. Of those, two subscriptions on average come through bundles or similar deals.

Leichtman Research Group, focusing tightly on subscription video‑on‑demand and direct‑to‑consumer services, reports a mean of 4.1 such services per household as of 2023. Among adults aged 18 to 44, that number climbs to 5.1 services, while older groups hold fewer.

Taken together, these studies describe the same basic reality from different angles. Most American households now live in the 4 to 7 subscription range, with BB Media’s 5.1 a reasonable shorthand for the current norm.

Streaming Has Replaced Cable as the Default

The growth in subscriptions has tracked a clear shift in how Americans watch TV.

Parks Associates says 91% of U.S. internet households now pay for at least one streaming video service. Traditional pay TV, by contrast, has fallen to 41% of households.

Long‑term data on cable and satellite underscore that reversal. S&P Global Market Intelligence reports that U.S. pay‑TV subscriptions declined for the ninth straight year in 2024. Penetration has dropped from over 80% of households in 2011 to just 34.4% by the end of 2024.

A November 2025 survey by All About Cookies, based on 1,000 U.S. adults, finds that only 30% of Americans still use traditional cable or satellite TV. Among those who cut the cord, 95% say they do not regret cancelling.

Streaming is not just widely available. It is now the main way Americans watch video. Pew Research Center reported in July 2025 that 83% of U.S. adults use streaming services, far more than subscribe to cable or satellite TV.

Nielsen’s “The Gauge,” summarized by Motley Fool in a 2025 “State of Streaming” roundup, shows the shift in viewing time. In March 2025, streaming accounted for 44% of U.S. TV viewing, compared with 24% for cable and 21% for broadcast.

In other words, the 5.1‑subscription household is not just an experiment. It has become the new default.

How Much Households Pay for All Those Logins

If five or six streaming services feel expensive each month, the data again agree.

Parks Associates estimates that U.S. consumers now spend about $109 per month on video services, in a market it sizes at $147 billion per year. Another Parks analysis from late 2024 put average household spending at $144 per month on streaming subscriptions and $91 per month on traditional pay TV.

A December 2025 Parks forecast projects that total U.S. subscription TV and video revenue will increase from $186.5 billion in 2025 to $190.7 billion in 2030. That suggests spending will remain high even as the industry matures.

Consumer‑side surveys paint a similar picture, though with different averages depending on what gets counted:

- The All About Cookies 2025 cord‑cutting survey finds that respondents subscribe to 3.4 streaming services on average, spending $48.13 per month on those. That is roughly $35 less than the $83 average cable bill self‑reported in the same survey.

- Bango’s 2025 study shows that 23% of American subscribers spend over $100 a month on streaming and other subscriptions.

- A 2024 Bango survey highlighted by Forbes found streaming video subscribers paying about $924 per year, or $77 per month, on average.

- A Motley Fool “Subscription Sanity” survey reports that about one‑third of respondents spend more than $100 per month on subscriptions of various kinds.

These figures do not perfectly align, but they share one conclusion. For many households, streaming is no longer the cheap, simple alternative to cable that it once seemed.

What a Single Service Costs in Late 2025

Rising subscription counts sit on top of rising individual prices.

Late‑2025 price guides from technology and entertainment outlets list typical monthly rates roughly in this range:

- Netflix

Standard with ads runs around $6.99–$7.99. Ad‑free plans range from about $15.49–$17.99 for standard to roughly $22.99–$24.99 for premium.

- Disney+

The basic ad‑supported plan costs about $9.99–$11.99 per month. The ad‑free tier is $15.99.

- Hulu

With ads, Hulu usually runs $9.99–$11.99. Ad‑free access costs about $18.99 per month.

- Max

The ad‑supported tier sits at about $9.99 monthly. Ad‑free options range from around $16.99 to $20.99.

- Prime Video

As a stand‑alone service, Prime Video costs about $8.99–$9.99. As part of Amazon Prime, monthly pricing lands in the $14.99–$17.98 range, with ad‑free options on the higher end.

- Paramount+

The Essential ad‑supported plan runs around $7.99–$8. The ad‑free Paramount+ with Showtime bundle is roughly $12.99–$13.

- Peacock

The Premium plan with ads costs about $7.99–$8. Ad‑free Premium Plus runs somewhere between $13.99 and the high‑teens per month, depending on promotions.

- Apple TV+

Apple’s service generally sits around $9.99–$13 per month, usually without an ad‑supported tier.

Analysts compiling these prices note that just four major services at current base rates can put a household “well north of $50 a month,” even before upgrades to ad‑free plans or add‑on bundles.

Multiply that by the 5.1 average subscriptions per household, and the “cheap streaming” narrative looks dated.

Bundles, Add‑Ons, and the Return of the Package

As costs climb, streaming companies are trying to keep customers by bundling services together.

A prominent example in late 2025 is Disney’s ESPN Unlimited bundle. ESPN Unlimited launched in August 2025 at $29.99 per month. A year‑end promotion lets new or returning customers get Disney+ and Hulu, both ad‑supported, included at no extra cost for 12 months at that same $29.99 price. An ad‑free version of Disney+ and Hulu with ESPN Unlimited costs $38.99 per month, which is lower than the usual combined pricing.

Research cited by CTAM shows that 23% of U.S. households already subscribe to at least one discounted streaming bundle and another 25% say they are likely to sign up for a bundle in the next six months. That trend suggests more households will experience streaming not as five separate subscriptions, but as overlapping packages resembling old cable tiers.

Telecom and wireless providers are also in the mix. A 2025 Business Insider feature describes Americans banding together with friends and roommates, not just relatives, to take advantage of broad “family” plans covering streaming, mobile service, and even fitness subscriptions. Phone carriers like AT&T and T‑Mobile increasingly market bundles that tie wireless service to multiple streaming platforms.

So the 5.1‑subscription household may not reflect five separate bills. Instead, it often reflects a knot of bundles, promos, and “family” deals that blur who actually pays for what.

Churn, Subscription Fatigue, and the Feeling of “Too Many”

Even with bundles, many viewers say they are overwhelmed.

Deloitte’s Digital Media Trends work shows that about 39% of U.S. consumers cancelled at least one paid streaming video service in the previous six months in 2025. Among Gen Z, churn reached 54% early in the year. In later 2025 reporting, millennials topped the list, with 51% cancelling at least one service over six months.

A broad summary of industry data by SQ Magazine notes similar numbers, with churn above 50% for Gen Z and millennials and around 39% overall.

Cord‑cutters show even more volatility. All About Cookies reports that nearly two‑thirds (64%) of cord‑cutters dropped a streaming service in the past year, often because of rising costs or a move to cheaper, ad‑supported plans. A related write‑up from the same group later in 2025 put that figure closer to three‑quarters, with 74 — 75% of respondents cancelling at least one streaming service during the year.

The financial frustration is clear in survey responses:

- Motley Fool’s subscription survey found that 57% of people believe they are overpaying for subscriptions, and about 40% feel subscribed to too many services. That feeling was strongest among younger adults.

- CTAM’s 2025 streaming trends page reports that 45% of consumers cancelled a streaming subscription in the last year because the cost was too high.

Earlier Deloitte research, still widely cited, helps explain the non‑financial frustrations. Around 66% of people reported irritation when shows disappeared from a platform. 53% were annoyed at needing multiple services to watch everything they wanted. More than half said it was hard to find content across so many platforms.

In other words, the problem is not only what the 5.1 subscriptions cost. It is also what they demand from people’s attention.

Password Sharing and the Shadow Economy of Extra Logins

One reason many households can maintain multiple services is that they are not paying for all of them directly.

Pew Research Center found in July 2025 that 26% of streaming users say they use the password of someone outside their household. Among adults under 30, that number jumps to 47%.

Streaming companies have noticed. Netflix long estimated that 222 million paying households shared accounts with about 100 million non‑paying households. After the company began enforcing paid sharing in the United States in May 2023, sign‑ups spiked. Data from analytics firm Antenna showed average daily sign‑ups rising to 73,000, a 102% increase over the prior 60‑day average. Netflix added 5.9 million subscribers globally in the second quarter of 2023, including more than one million in the U.S. and Canada.

Disney has started to follow that path. In fall 2024, Disney+ rolled out “extra member” slots. Subscribers can add someone outside the household for $6.99 per month on the ad‑supported plan or $9.99 on the ad‑free plan. Extra members get a single profile and one device at a time and cannot have previously held their own Disney+, Hulu, or ESPN+ subscription.

At the same time, some companies are quietly accepting looser definitions of “family.” Business Insider’s 2025 reporting highlights how friends and roommates coordinate to fit into broader family plan rules for phone, streaming, and gaming services in order to ease the cost burden.

The result is a complex ecosystem where the 5.1‑subscription average reflects both official accounts and informal sharing arrangements.

Ads, FAST Channels, and Cheaper Ways to Keep Watching

As prices rise, many viewers are choosing cheaper, ad‑supported plans instead of cancelling entirely.

Deloitte’s 2024 Digital Media Trends report found that 46% of U.S. households subscribe to at least one ad‑supported tier of a paid streaming service. It also reported that 57% of households use at least one free, ad‑supported streaming service.

Parks Associates updated that picture in October 2025. Looking at eight leading subscription ad‑based video‑on‑demand services, the firm found that 59% of subscriptions were for the cheaper basic tiers with ads.

Free ad‑supported streaming TV, or FAST, is also expanding rapidly. Comscore says that viewing hours on major FAST services grew 43% year over year by August 2025. The company also reports that Netflix’s own ad‑supported tier now accounts for 45% of its household viewing hours, up from 34% in 2024.

SQ Magazine, summarizing industry research, notes that by late 2024, weekly FAST users made up 46% of total video consumers in the United States. It counts around 1,850 FAST channels globally by mid‑2025.

Ad tiers and FAST channels are becoming the pressure valve for subscription overload. They let households keep multiple services while holding the total bill down, even if that means more ads than they originally signed up for.

Too Many Services, Too Many Choices

Beyond money and time, many people simply feel overwhelmed by the number of options.

CTAM reports that 84% of consumers say ease of content discovery is important when they choose a video or service provider. That concern is growing as more services crowd the market. CTAM also notes that a smaller share of people are now signing up for a platform just to watch one specific show, with that behavior falling from 41% in 2023 to 37% in 2025.

At the same time, recognition is low. CTAM cites research showing that many viewers cannot reliably say which service carries popular shows such as The Bear or Game of Thrones, even after seeing extensive promotion.

Motley Fool’s “State of Streaming” summary, which pulls together several industry surveys, says that 62% of streaming subscribers believe there are too many options. Its analysts note that most studies still place the average number of paid video streaming subscriptions around four, depending on the method used, but that does not necessarily make people feel in control.

Time‑use data captures how streaming has filled people’s days. Parks Associates reports that U.S. households now consume 53.4 hours of video per week across all devices, more than double the 23.3 hours per week in 2010. Another Parks release breaks that into about 35.6 hours per week across devices, with 20.4 hours on TV sets, 8.1 hours on smartphones, and 3.1 hours on tablets.

Comscore adds that 96.4 million U.S. homes now use internet‑connected TVs, an increase of about 849,000 households in one year, and that they stream nearly five hours per day on average.

The 5.1‑subscription household does not simply pay for more services. It also devotes significantly more of the week to watching them.

Sports: The Expensive Glue Holding Extra Subscriptions

Sports fans often feel the subscription burden most acutely.

An AP‑NORC poll from August 2025 found that about six in ten dedicated sports fans rely on a mix of cable and multiple streaming services or add‑on packages such as NFL Sunday Ticket and NBA League Pass. Roughly half of fans told pollsters they were dissatisfied with how much they must pay to follow their teams.

With leagues and conferences cutting new streaming deals, a fan can easily end up stacking services just to keep up. That reality helps pull some households toward the higher end of the subscription range, even if they might otherwise be comfortable with fewer platforms.

What Happens Next

The numbers behind America’s 5.1‑subscription household point in two directions at once.

On one hand, streaming has clearly won the attention battle. More than 90% of U.S. internet households have at least one streaming service. Streaming already accounts for 44% of TV viewing, and connected‑TV use keeps growing. Average households now build their own packages across five, six, or even seven services.

On the other hand, warning signs are everywhere. A significant share of households tell surveyors they are overpaying or have too many subscriptions. Churn rates near or above 40% show how often people are cancelling and reshuffling their lineups. Password‑sharing crackdowns are closing some loopholes, while ad‑supported plans and FAST channels rush in as cheaper alternatives.

Industry researchers expect some of this to shake out. Parks Associates, for example, has publicly predicted that consolidation among streaming services will accelerate in 2025 and beyond, after the surge from 154 standalone services in 2015 to mid‑300s today. CTAM’s count of 745 platforms in the U.S. and Canada, even with regular shutdowns, suggests plenty of room for mergers or closures.

For households, though, the next few years are likely to feel less like a clean reset and more like constant adjustment. New bundles will appear. Prices will move. Promotions like ESPN Unlimited plus Disney+ and Hulu will come and go. Viewers will keep cycling through logins, deciding which services are essential and which can be paused or dropped.

In that environment, the 5.1‑subscription household is not just a headline statistic. It is a snapshot of a country still figuring out how much TV it really wants, and how many monthly charges it is willing to live with to get it.